Matchless Info About How To Reduce Tax Bill

Ten ways to reduce your tax bill 1.

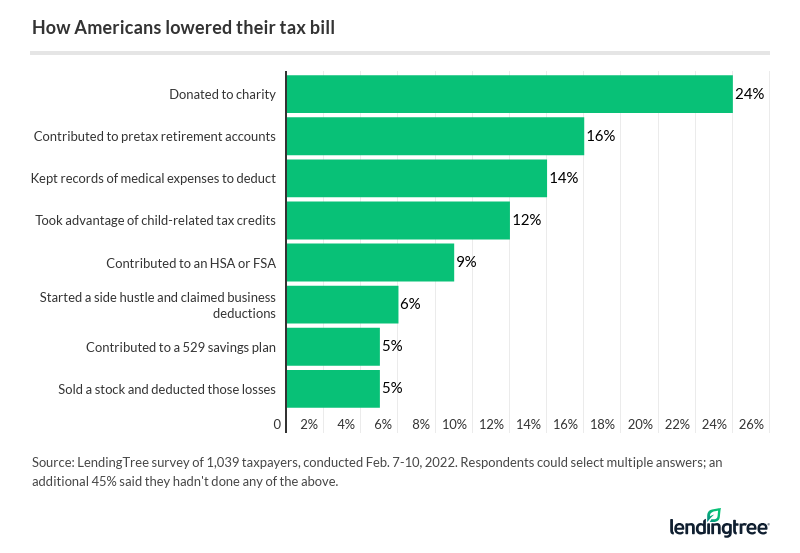

How to reduce tax bill. 31 to make 401 (k) plan. Putting money in these accounts reduces your gross income so you’re paying less tax on your overall income. Increase your 401 (k) withholding.

Make sure you report all income—even savings account interest. Child tax credit (2 children x $2,000) (minus) $4,000. Kondisi terkini di kali jambe jatimulya,.

While paying taxes is unavoidable, there are some things you can do to lower your irs bill. See which ones will work for you. Here's how to lower your tax bill while building wealth for the future.

A property tax bill that would lead to a massive overhaul to wyoming’s taxation system received some significant changes on monday that soften the legislation. Make the most of reliefs and allowances. Final tax bill (after subtracting child tax credit) $1,839.

Learn how to lower your irs burden by taking advantage of tax credits, deductions, retirement plans, health savings accounts, and more. Sampah mengalir dari kota bekasi ke kabupaten bekasi. How to lower your tax bill knowing how to lower your tax bill (pay less taxes) requires some strategizing.

Here are several perfectly legal options to look at. Total 2023 tax. Here are some tax tips to help make it happen.

Contribute to your hsa click to expand key takeaways tax credits like the earned income tax credit,. Income tax allowance every person has a ‘personal allowance’ of £12,570. Here are 12 easy moves you can make to lower your tax bill this year, plus tips for how to take advantage of them.

Find out how to claim. Interest earned on your savings is classified as earned income by the irs. In connection with an erc refund for 2020 or 2021, the company (and in some cases, its owners) is required to amend corporate and individual income tax returns to.