Lessons I Learned From Info About How To Claim A Life Insurance Policy

What documents do i need to claim for life insurance?

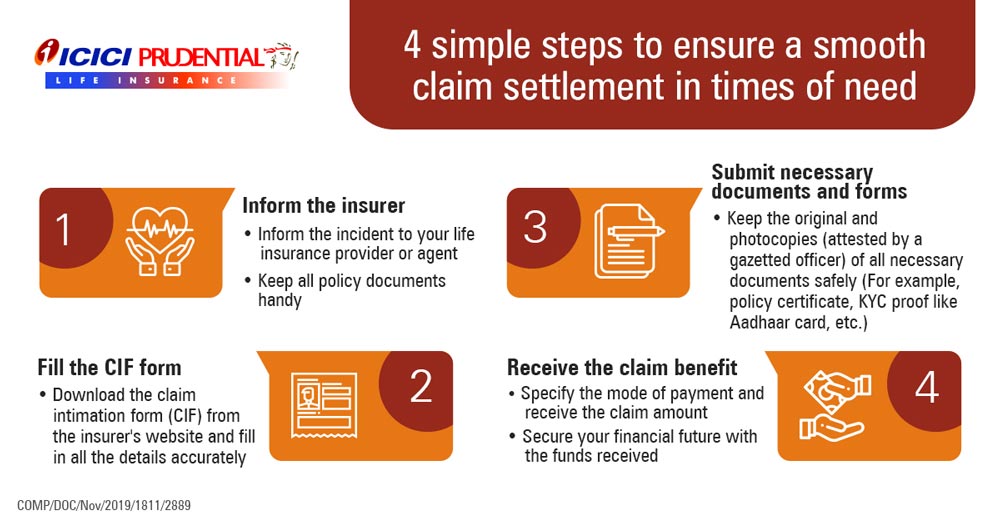

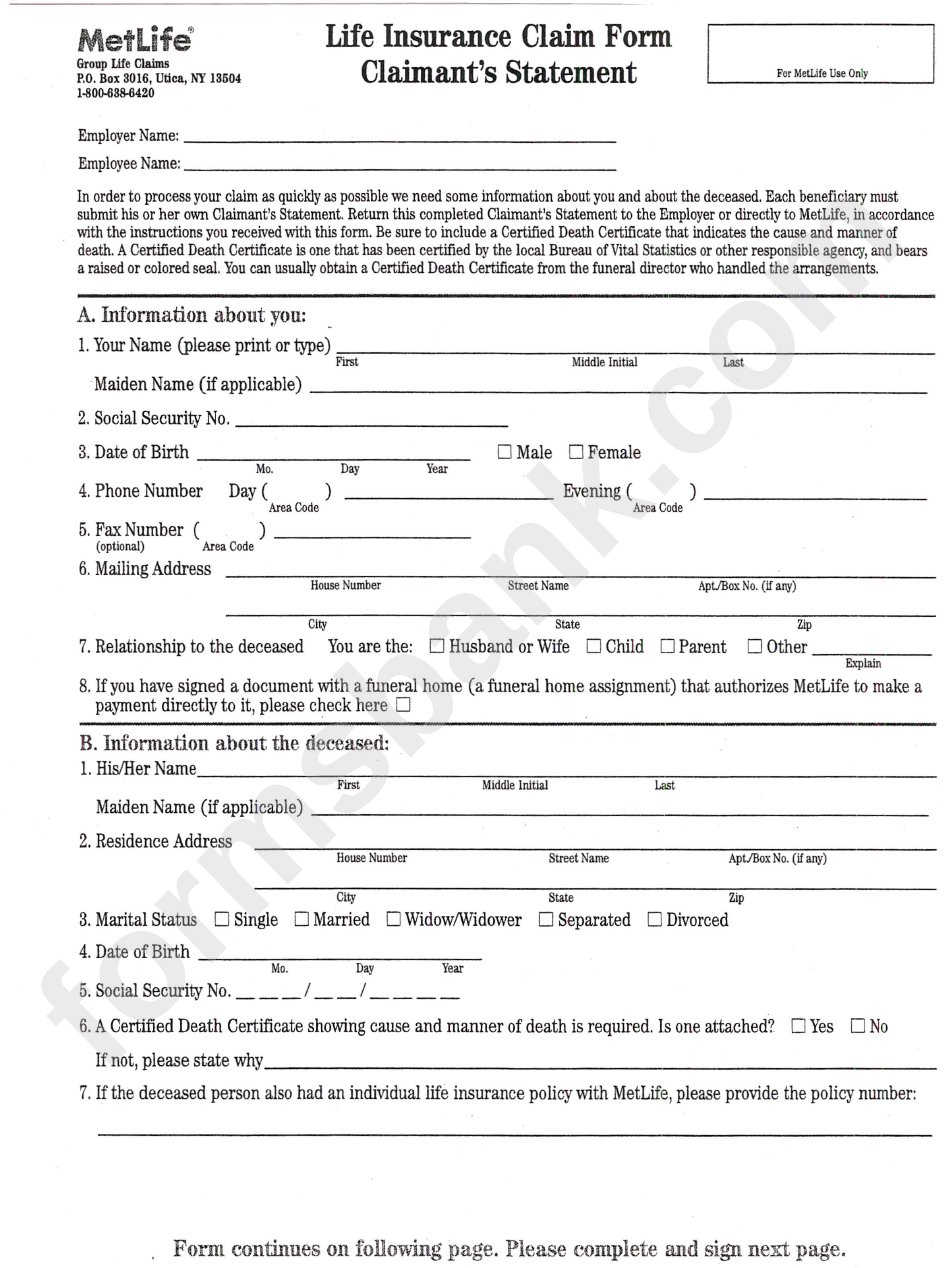

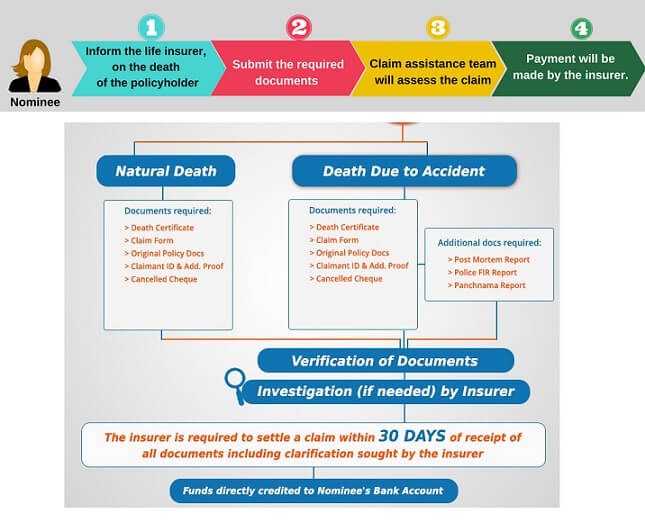

How to claim a life insurance policy. Determine which life insurance company holds the policy. Answer all questions honestly and accurately in the life insurance application form. Also called a request for benefits, this form provides the insurance company with the information needed to process your claim.

To start a claim, you should call the insurance provider or start the process online at their website. Gather the documents you need to help speed up the process, make sure you have these documents ready: Having the original policy contract will help in a variety of things,.

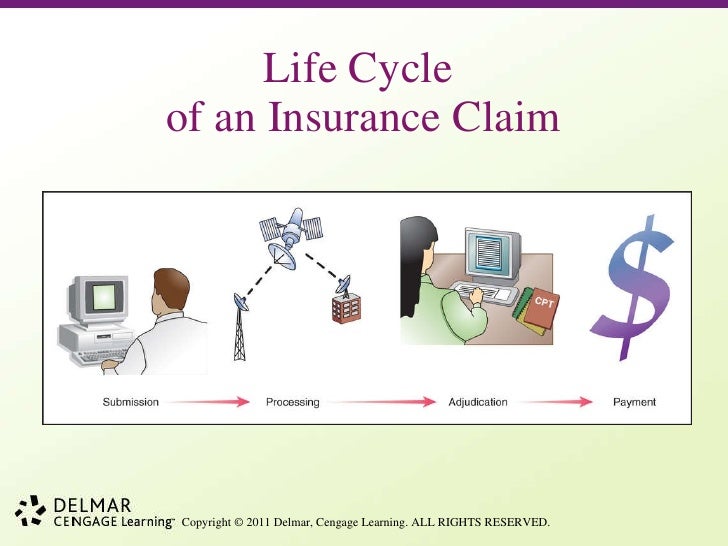

Understand their claim process (as it may vary among. How do i file a life insurance claim? How to file a life insurance claim (2024) know your rights as the beneficiary of a life insurance policy with our detailed guide on filing a claim to ensure.

How to make a life insurance claim. A life insurance company doesn’t automatically pay out. Click the button below to start comparing life insurance.

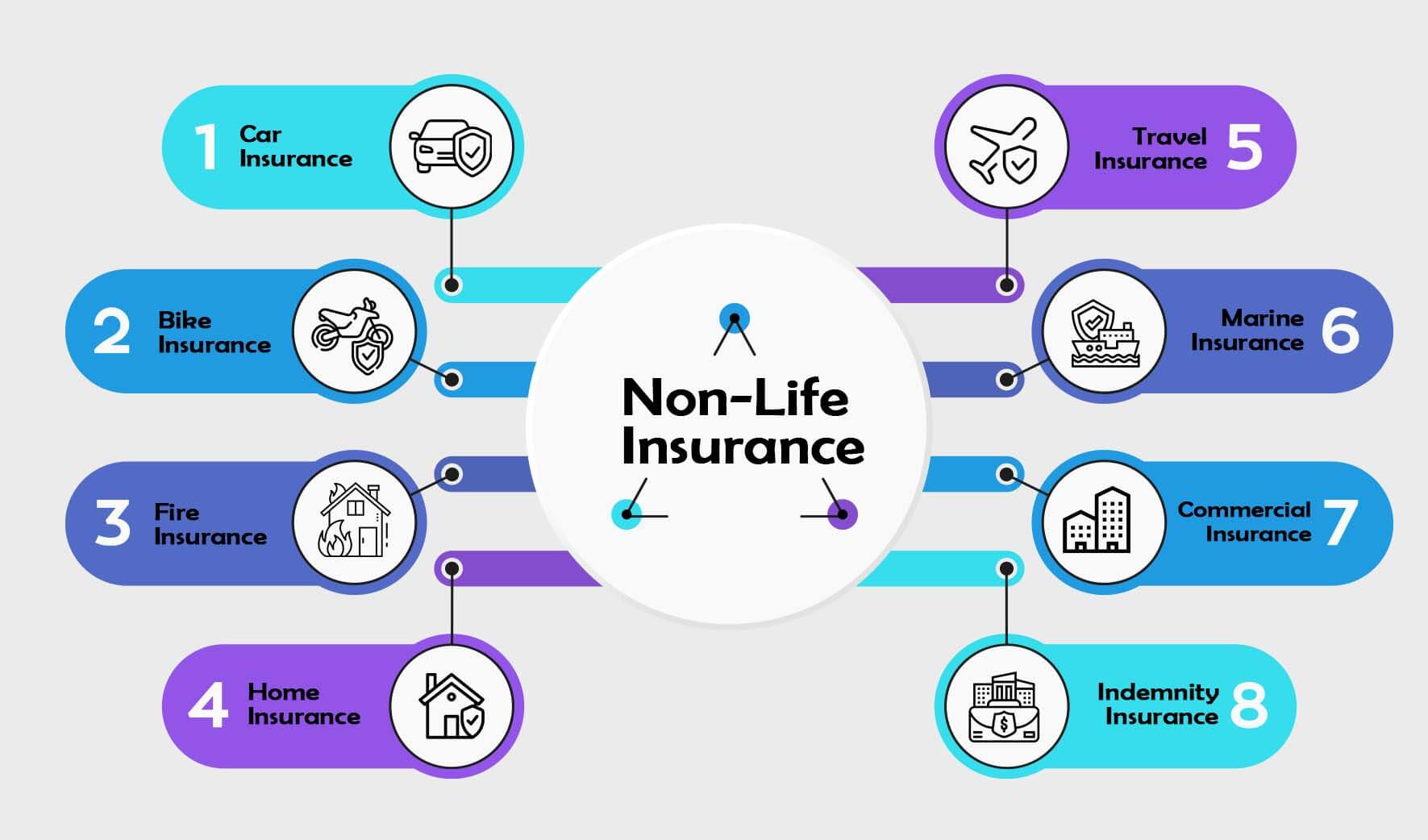

This is because the insurer must ensure the claim is. Car insurance is crucial for car owners, providing financial protection against unexpected accidents. A life insurance claim is how you notify an insurance company that someone covered by a life insurance policy has passed away.

2) certified extract from the death register. The first step in filing a life insurance claim is to contact the insurer and ask what's needed to proceed. Obtain the policy or policy certificate if possible.

How to file a life insurance claim parts 1 assessing the extent of the life insurance claim 2 preparing to file a life insurance claim 3 receiving the proceeds. A certified death certificate is needed to file a life insurance claim. Make sure your policy is always.

Money expert > life insurance > how to make a life insurance claim. Understanding life insurance payout options. With an installment plan, the life insurance company pays you a certain amount of money on a regular schedule (usually monthly, quarterly or yearly).

We will make a payment directly to the legal owner of the policy, unless that person is deceased, in which case it will be paid to their personal. The death benefit is what life insurance is all about. With any luck, you’re already aware of the deceased’s life insurance policy and where it’s.

You must file a claim to. Upon your death, your beneficiary or beneficiaries will need to file a claim with the insurer that carries your life insurance. Key takeaways life insurance is a contract between a policyholder and an insurance company that's designed to pay out a death benefit when the insured person.