Perfect Info About How To Buy Uk Gilts

:max_bytes(150000):strip_icc()/gilts.asp-final-d4f71f8e86f44ff6b0909fe3d5c57b8b.png)

Home > bonds > what are gilts?

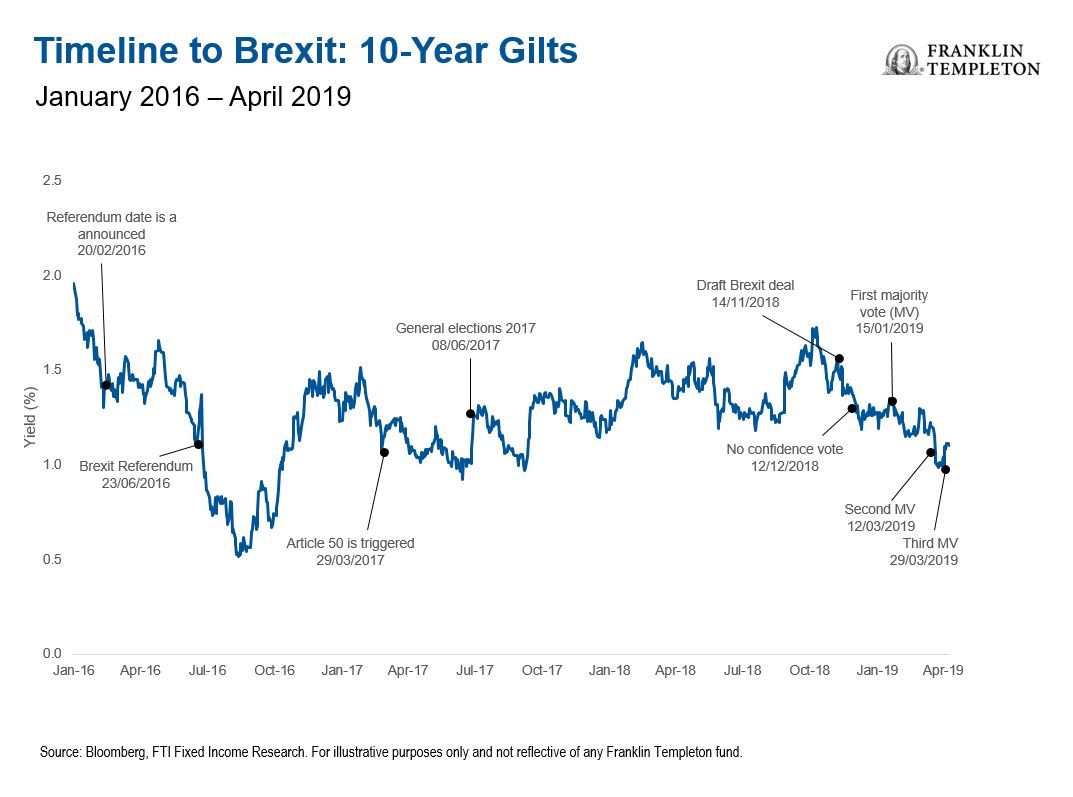

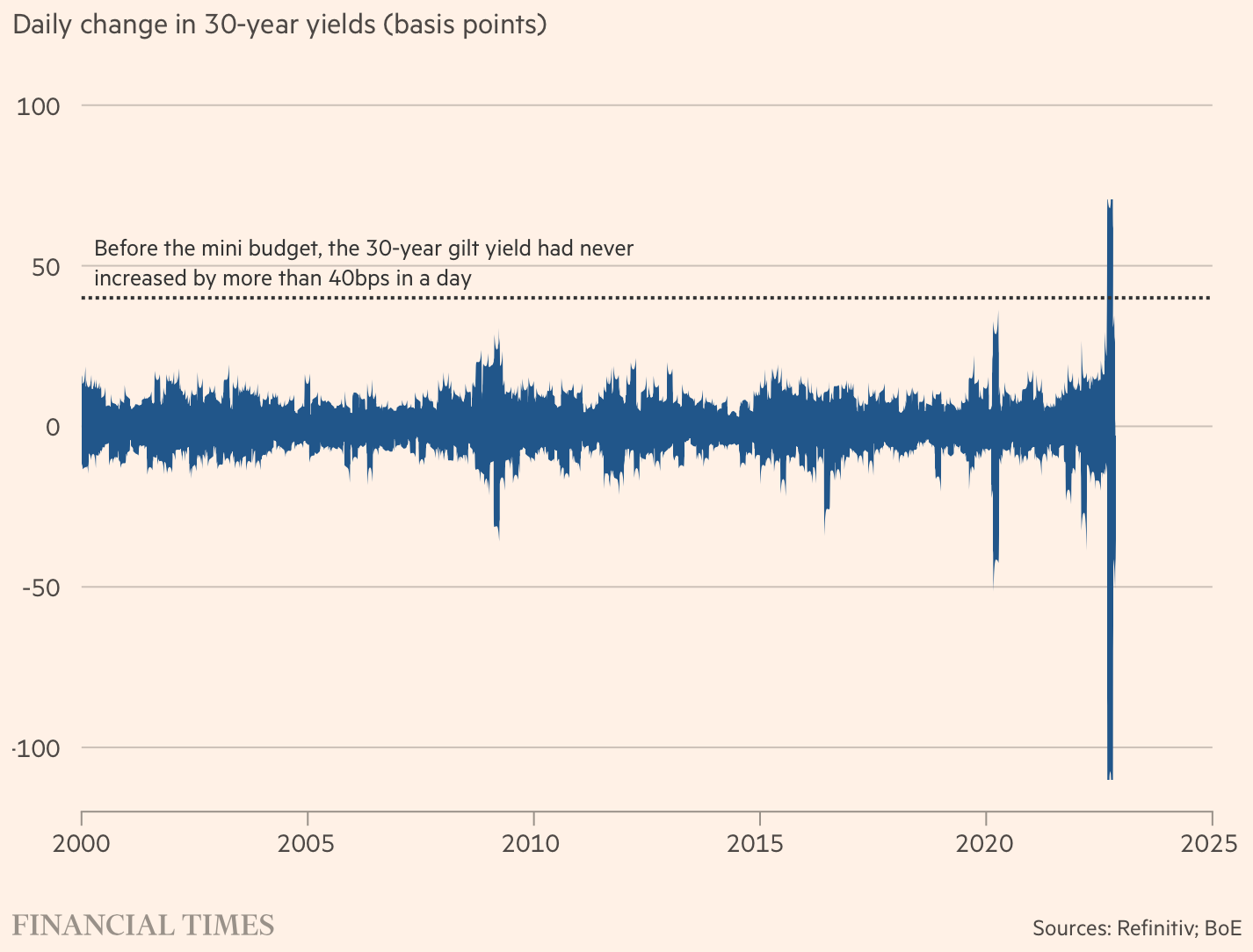

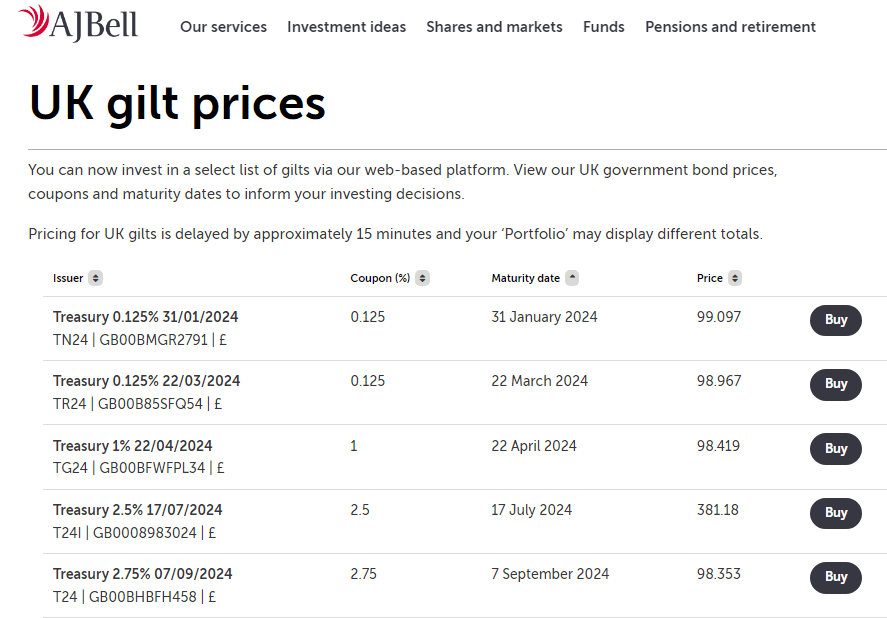

How to buy uk gilts. Gilts are traded on the london stock exchange and can be bought through investment platforms such as hargreaves lansdown, aj bell or. In this guide, we break down the pros and cons of investing in uk government bonds, also known as gilts. The value of your investments may go down as well as up.

By sam benstead from interactive investor share on from understanding yields and tax breaks, to picking the right bond, sam benstead has the answers. You may not get back all the money that you invest. How can i buy one?

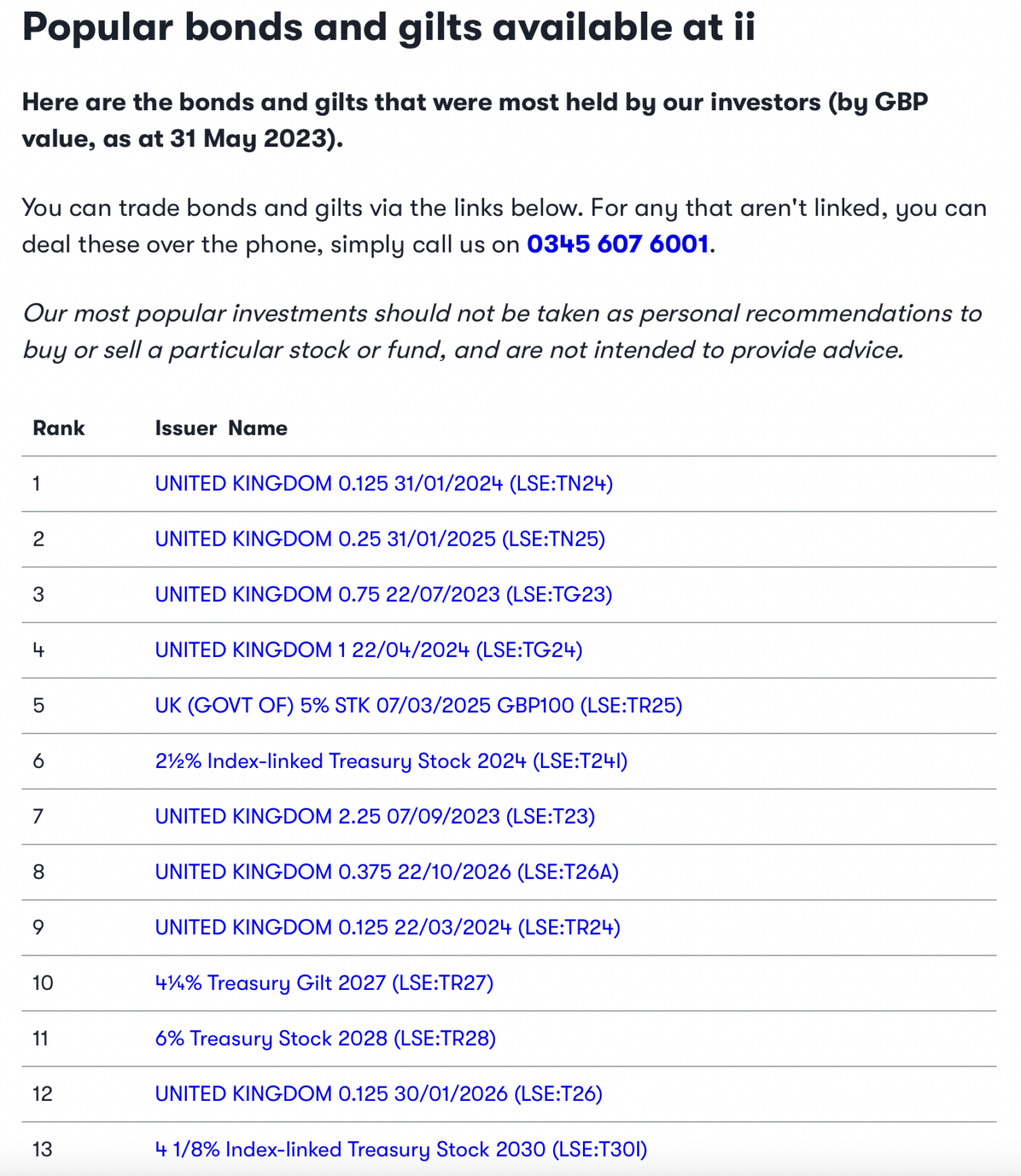

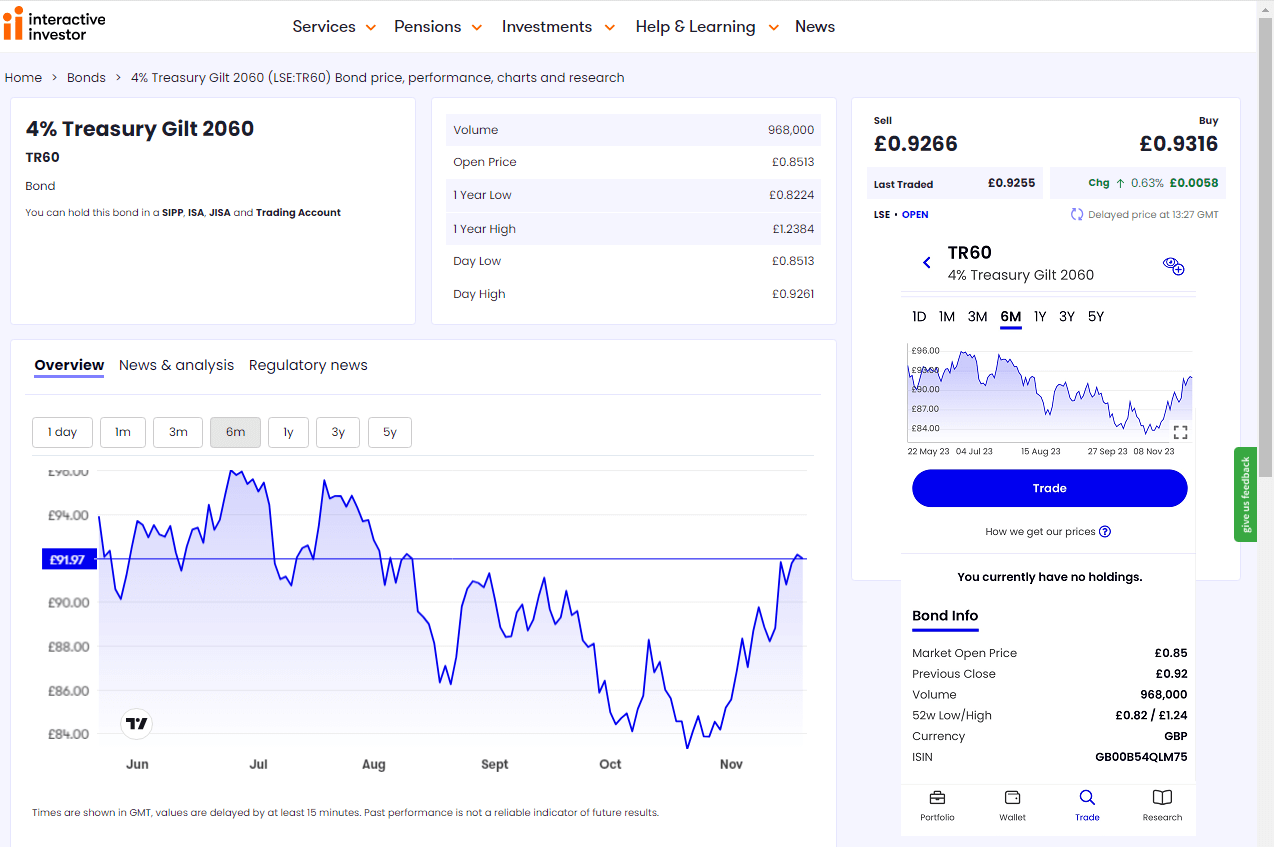

Gilts can be purchased from the secondary market through a stockbroker, bank or via the dmo’s purchase and sale service. The treasury 4% 2031 is a new gilt launching on the london stock exchange. Details on how to buy and sell gilts gilt market

Bonds hub what are gilts? View gilt and bond prices register for bond launch alerts. How can you invest using them, and where?

If you wish to use the. A gilt is a uk government liability denominated in sterling, issued by hm treasury and listed on the london stock exchange. See our list of tradeable gilts or, to access our full range,.

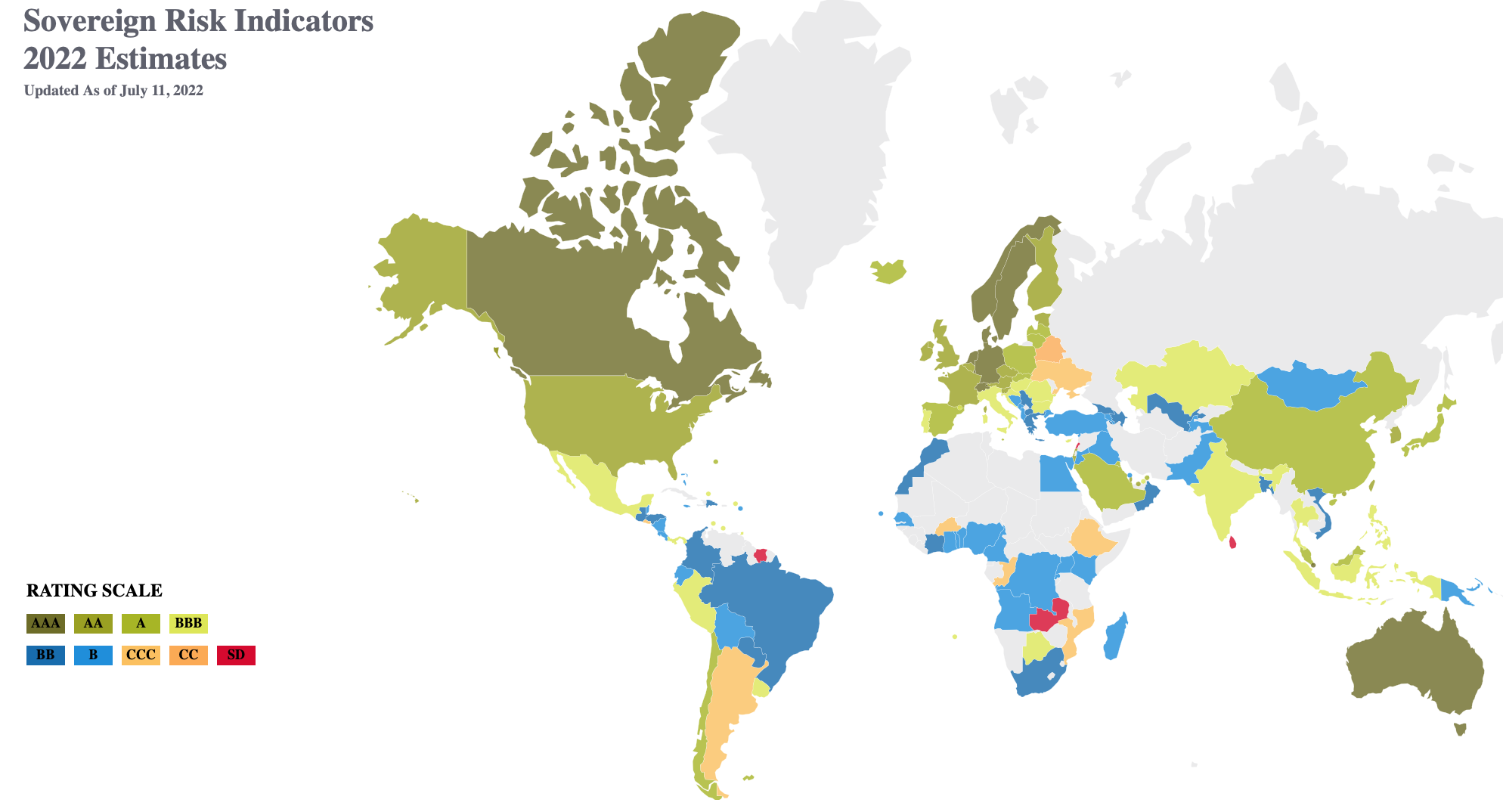

What you need to know about buying government bonds (gilts) as interest rates have increased, so has the interest in government bonds (gilts). Learn how to buy and sell gilts through a stockbroker, bank or the dmo’s purchase and sale service. Find out the features, benefits and risks of gilts, the indicative market values, the glossary of terms and the reports and indicative market values of gilts.

This means you’ll receive 4% of the nominal value. But what are gilts, how do. Say you invest £1,000 in a gilt with the name “4% treasury gilt 2035”, which is how gilts are typically named.

Online brokers offer access to this week’s auction. Directly from the uk government: The uk has opened up access for retail investors to buy newly issued gilts, as the government seeks to tap fresh sources of demand in a record year for bond sales.

Updated june 28, 2023 reviewed by gordon scott investopedia / ryan oakley what are gilts? Uk retail investors will be able to buy gilts at the same price as primary dealers, the latest step aimed at broadening access to government bond markets in. And crucially they will not pay any commission or.

Buy and sell corporate bonds, gilts and pibs. The gilts can be held in an isa, which has a 0.45% annual charge capped at £45 for this type of asset. Gilts are government bonds in the u.k., india, and commonwealth countries.